Frequently Asked Questions

Medicare Supplement or otherwise known as Medigap is basically a secondary health insurance plan that fills in the gap that traditional Medicare Part A and Part B do not cover. You are responsible for Part A deductibles and co-payments, which can be very costly for frequent hospital admission and lengthy hospital stays. Traditional Medicare covers 80% of Part B Medicare approved claims. You are responsible for the other 20% of all outpatiement costs.

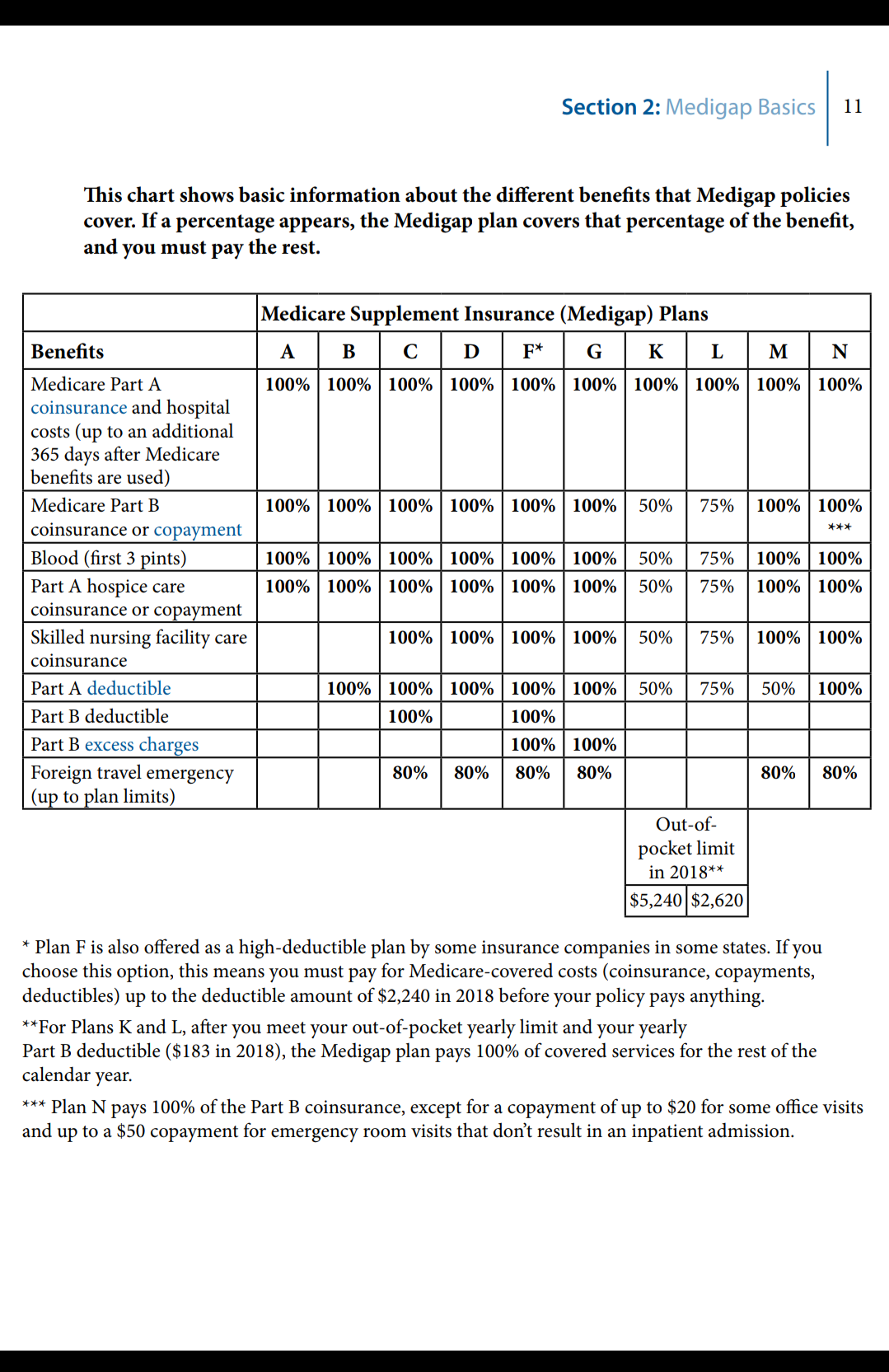

All Medi-gap policies must abide by federal and state laws designed to protect you. All Medicare Supplement companies must offer the same basic benefits, no matter which insurance company sells it. According to the 2018 official government Medigap Guide Book on page 9; Cost is usually the only difference between Medigap policies with the same letter sold by different insurance companies. For example: If you’re paying $100 more for Plan F with United HealthCare and if Mutual of Omaha Plan F is $100 cheaper…You have chosen to pay more money with a Medicare Supplement company that is offering the exact same plan for $100 more per month. You’re essentially paying $1,200 more per year for the exact same Plan F. Unfortunately, most seniors do not realize that they can save $500-$1200 on average per year by simply switching to a lower cost Medicare Supplement company that offers a lower rate with the Exact Same Letter Plan. Rates usually differ among insurance companies based on their claims experience, inflation, internal operation costs, etc

You can speak with our licensed insurance agent that will rate shop the lowest cost plans in your area at absolutely no cost to you. Your application can be taken over the phone or in person if you are in our service area. You’ll have to medically qualify by answering a few health questions which vary among Medigap companies. In addition, whatever prescription drugs you’ve taken within the past 2 years will be considered for approval. Once you are approved, there are no change of benefits if you select the same Letter Plan. Now if you choose a different letter plan for example switching from Plan F to Plan G. There’s a minimal difference between both plans, which is the Part B annual deductible of $183 in 2017 that would not be covered in Plan G but could save you over $1,000 per year by choosing this plan type.

Unfortunanetly, Medicare Part A has high deductibles and co-pays and B only covers 80% of Medicare approved claims. You are responsible for the deductibles, co-pays and 20% for Outpatience Services, such as doctor visits, treatments, lab work, MRI, surgeries, and durable equipment. Medicare Supplement Plans can cover 100% of these costs after you pay an annual Part B deductible which is $183 in 2018. There are several Medicare Supplement Plans to choose from. (see Medicare Supplement Chart below)

Original Medicare is a federal insurance program that covers U.S. citizens and permanent legal residents who are 65 years of age and older. It also covers those under 65 with certain disabilities and serious kidney diseases. Part A provides hospital coverage plus some skilled nursing facility, hospice, and home health care. Part B provides coverage for Doctor visits and most other outpatient care.

Unfortunately, prescription plans must be purchased separately from Medigap plans through a private insurance company that is Medicare approved. Otherwise known as Part D (a stand-alone Medicare Prescription Drug Plan) Please go this Medicare.gov link to shop for the most suitable prescription coverage for yourself.

https://www.medicare.gov/find-a-plan/questions/home.aspx

Annuity offers principle and growth protection for retirement and Guaranteed Income for Life. An annuity is a contract agreed upon between an insurance company and yourself. This contract is an

agreement to make payments at agreed intervals, usually after retirement. Taxation on these payments occurs when you begin to receive distributions or makes withdrawals. All retirement annuities are tax-deferred, which means taxation is postponed until the withdrawal period. All earnings from annuities are subject to tax penalties if they’re withdrawn before reaching the age of 59 ½.

What is the difference between fixed an annuity and variable an annuity?

A Fixed an annuity will payout a specific interest payment and does not participate in the stock market, mutual funds, or any other investment vehicle, which keeps your principal and accrued interest safe from any losses.

A Variable annuity is dependent on the market value of the investment and has higher fees than most fixed annuities. Variable annuities may result in loss of principal and interest.

What happens if an annuitant dies?

If an annuity owner dies within the period of accumulation, the beneficiary will be paid the accumulated amount. This would be taxed as ordinary income and included in estate taxes.

Why should I consider an Annuity?

Annuities can help you grow and protect what you’ve saved from your 401k, mutual funds in an IRA or any other retirement vehicles that may be exposed to market risk or poor growth potential. They provide guaranteed income for you and your loved ones regardless of market performance or volatility. Fixed or Index Annuities Protect your retirement savings from down markets. It can provide predictable and guaranteed lifetime income for today or in the future. This can be a good solution if you’re concerned about outliving your liquid asset and want the security of a fixed monthly income for life or for any chosen period of time. Fixed Index Annuities are paying between 4-7% returns in 2018 with no market risk.

If you would like to request an Illustration showing Growth potential or Income options

Please contact us at (888)484-1020

Dental, Vision and Hearing Plans

**Contact Us For the Most Popular Dental, Vision and Hearing Plans**

The Importance of Dental • Vision • Hearing

• Quality of Life

• Unforeseen situations that are painful, inconvenient and expensive

• Basic Medicare does not cover dental, vision or hearing expenses.

Products Highlights For the Most Popular Plan

• Choose your dentist – No Networks • Family Rates (includes a maximum of 3 children)

• Individual 18 – 85 • $1,000 – $1,500 policy year benefit option available

• Individual 18 – 85 • $1,000 – $1,500 policy year benefit option available

• Guaranteed Issue

• Guaranteed renewable for life.*

-Plan Benefits 1 Eligibility Anyone age 18 – 85

-Policy Year Maximum Benefit $1,000 or $1,500 (choose one)

-Policy Year Deductible $100 per person

-Dental Coverage Preventive Services Semi-Annual exams, cleaning and x-rays. Year 1 – 60% Year 2 – 70% Year 3 and thereafter – 80%*

-Waiting Period None

-Including x-ray (other than “full mouth”), fillings and extractions

-Year 1 – 60% Year 2 – 70% Year 3 and thereafter – 80%*

Waiting Period None

-Major Services Including bridges, crowns, full dentures or partials, full mouth extractions, and root canals

Year 1 – 0% Year 2 – 70% Year 3 and thereafter – 80%* Waiting Period 12 months

-Vision Coverage Basic eye exam, eye refraction, including the cost of eye glasses or contact lenses

Year 1 – 60% Year 2 – 70% Year 3 and thereafter – 80%

* Waiting Period 6 months on eyeglasses and contact lenses

-Hearing Coverage

Exam, hearing aid and necessary repairs or supplies

Year 1 – 60% Year 2 – 70% Year 3 and thereafter – 80%

*Waiting Period 12 months new hearing aids and existing hearing aid repairs

The hardest thing we must ever face is the death of a loved one. On top of this, surviving loved ones are often left to handle any end-of-life medical expenses and funeral costs. These expenses can add to the sense of grief and stress surviving family members feel.

Final expense insurance is most often a type of (Whole Life) permanent life insurance used to cover medical costs and other end-of-life expenses. These costs usually include caskets, transportation, preparation of the body, grave liners, flowers, or the headstone and cremation. The average funeral cost is between $10,000-$15,000. A final expense policy can help with these costs and protect your family from experiencing a financial burden.

Most whole life policies last for the life of the policyholder and some accumulate cash value.

Easy qualification. Because the coverage amount is lower than other types of life insurance, most final expense policies do not require a medical exam to qualify. Most policies can be issued based on answers to health questions on the life insurance application. There are coverages available with No Health

Questions, which are Guaranteed acceptance.

Some types of whole life policies allow you to pay premiums for shorter

periods of time, such as 20 years, or until age 65. This usually results in higher

premiums than with ordinary life, because payments are made during a

shorter time.

You may also borrow against the cash value with a loan. * Any money owned

in the form of a policy loan is deducted from the benefit paid when you die, or

from the total cash value if you stop paying premiums.

If you were diagnosed with Cancer or suffered Heart Attack or Stroke, the last thing you would want

to worry about is how it would affect your financial situation. One of the main reason is that out-ofpocket

medical expenses are on the rise. These funds are paid directly to you and pays

regardless of any other insurance coverage you may have. You can use these cash benefits to

cover Medical Co-Payments, Deductables, and Prescription Drug Copays, Supplement Lost Income,

help pay bills such as car, rent, mortgage payments, and allows extra time off of work.

These benefits will give you a peace of mind. The chances of beating cancer has increased in recent

years. 1/3 of cancer, heart attack, and stroke patients have depleted their savings or had to borrow

against their retirement plans during these critical events.

We have plans that will pay you CASH BENEFITS for: Hospital Confinement, Observation Stays,

Inpatient Mental Health and Emergency admission to hospital, Ambulance service, Skilled Nursing

Facility, Outpatient surgery, and Accidental Death and Dismemberment.

Hospital Benefits will pay you a daily benefit amount between $100-600 per day should you be

confined to a hospital. Benefits are paid directly to you so you can use the cash funds any way you

choose.

Example: 67 years old hospital benefit $100 per day for 10 days as low as $12.97 per month

Cancer, Heart Attack, and Stroke Lump Sum Benefits that may cover Experimental Treatments,

Late State Diagnosis, Skin Cancer and More. Ages 18-90 and up to $75,000 plan benefits

Example: 65 years old male non-smoker for cancer diagnosis $5,000 lump sum benefit as low as

$17.08 per month or $10,000 lump sum benefit for $32.08 monthly premium

Yes….Absolutely! If you switch companies, your coverage and benefits will not change. The benefits and freedom to go to any Physician, Hospital or Medical facility will remain the exact same. You’ll keep your existing Doctors and visit the same medical facilities that you have with your current plan.